1.067.715

kiadvánnyal nyújtjuk Magyarország legnagyobb antikvár könyv-kínálatát

VISSZA

A TETEJÉRE

JAVASLATOKÉszre-

vételek

Development & International Cooperation June-December 1995 I-II.

Introduction of New Currencies and National Monetary Sovereignty/Volume XI Number 20-21

| Kiadó: | Centre for International Cooperation and Development |

|---|---|

| Kiadás helye: | Ljubljana |

| Kiadás éve: | |

| Kötés típusa: | Ragasztott papírkötés |

| Oldalszám: | 408 oldal |

| Sorozatcím: | Development & International Cooperation |

| Kötetszám: | |

| Nyelv: | Angol |

| Méret: | 24 cm x 17 cm |

| ISBN: | |

| Megjegyzés: | További kapcsolódó személyek a könyvben. Fekete-fehér ábrákkal. |

naponta értesítjük a beérkező friss

kiadványokról

naponta értesítjük a beérkező friss

kiadványokról

Előszó

TovábbFülszöveg

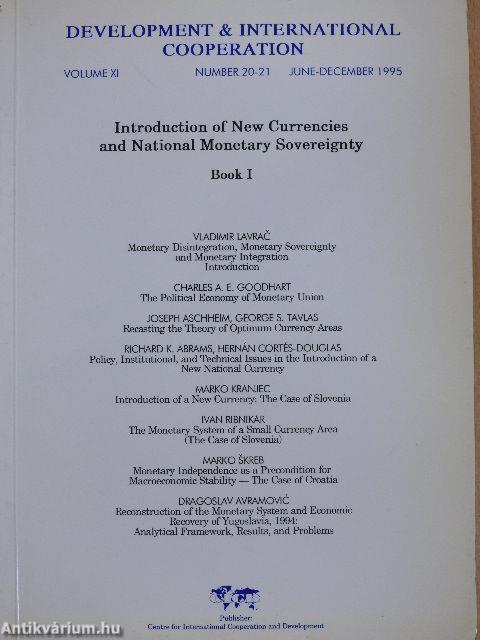

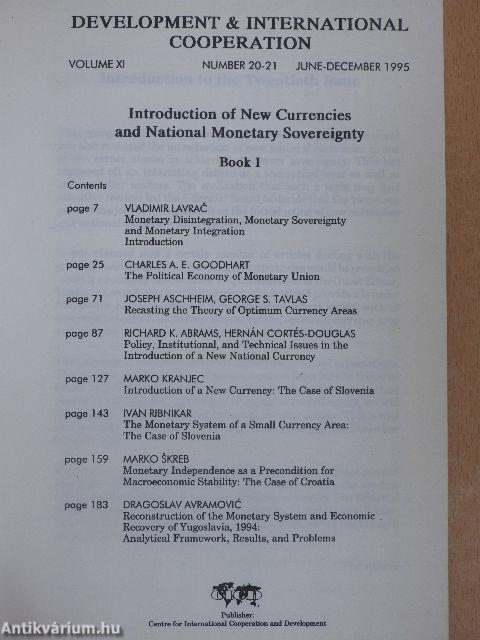

DEVELOPMENT & INTERNATIONAL COOPERATION

VOLUMEXI NUMBER20-21 JUNE-DECEMBER 1995

Introduction of New Currencies and National Monetary Sovereignty

Book I

CHARLES GOODHART The Political Economy of Monetary Union

Thus the evidence would seem to be that the theory of optimal currency areas, at least as normally applied, has relatively little predictive power. The fact is that virtually all independent sovereign states have a single currency, and that changes in sovereign status (e.g. the dissolution of the former USSR and Yugoslavia) lead rapidly to accompanying adjustments in monetary autonomy. It is hardly

credible to believe that the boundaries of such sovereign states generally exactly coincide with optimal currency areas, or, even less credible, that changes in such boundaries, and hence in currency areas, reflect shifts in optimal currency areas. Clearly there must be a large element of political influence in the practical determination of which geographical areas will use... Tovább

Fülszöveg

DEVELOPMENT & INTERNATIONAL COOPERATION

VOLUMEXI NUMBER20-21 JUNE-DECEMBER 1995

Introduction of New Currencies and National Monetary Sovereignty

Book I

CHARLES GOODHART The Political Economy of Monetary Union

Thus the evidence would seem to be that the theory of optimal currency areas, at least as normally applied, has relatively little predictive power. The fact is that virtually all independent sovereign states have a single currency, and that changes in sovereign status (e.g. the dissolution of the former USSR and Yugoslavia) lead rapidly to accompanying adjustments in monetary autonomy. It is hardly

credible to believe that the boundaries of such sovereign states generally exactly coincide with optimal currency areas, or, even less credible, that changes in such boundaries, and hence in currency areas, reflect shifts in optimal currency areas. Clearly there must be a large element of political influence in the practical determination of which geographical areas will use a single currency.

JOSEPH ASCHHEIM, GEORGE S. TAVLAS Recasting the Theory of Optimum Currency Areas

In recent years, the theory of optimum currency areas has been modified in line with developments in other areas of macroeconomic theory. Two developments are particularly relevant to the discussion. The first concerns the formation of inflation expectations, which has implications for whether a long-run (or even a short-run) trade-off actually exists between inflation and unemployment. If such a trade-off does not exist, then it is preferable for nations to aim for a low rate of inflation.

The second development — which is the time-inconsistency issue — provides guidance as to how monetaiy authorities can best make credible their commitment to reducing inflation. These developments seek to clarify the benefits and costs of currency area participation so that a country can "get it right" in deciding whether to join a currency area. For one drawback from "getting it wrong" is the high cost of dissolving the currency linkages later on.

RICHARD K. ABRAMS, HERNÁN CORTÉS-DOUGLAS Policy, Institutional, and Technical Issues in the Introduction of a New National Currency

Countries often wish to introduce their own separate currency either as a symbol of national independence or on other grounds that are not primarily economic. However, the principal economic benefit of a national currency is that it provides a countiy with a measure of independence in national monetary or exchange rate policies. Such a course of action is especially advantageous if the authorities are dissatisfied with the monetary or exchange

rate policies being pursued within the single currency area, and they cannot separately control domestic credit within the currency area. While monetaiy independence may be the main "benefit" of introducing a new currency, this may not prove to be a benefit at all unless it is used to achieve a degree of financial stability. This can only be achieved if sound financial policies are in place at the time — or soon after — the new currency is introduced. Vissza

Témakörök

- Közgazdaságtan > Gazdaságpolitika

- Közgazdaságtan > Közgazdasági elméletek > Egyéb

- Idegennyelv > Idegennyelvű könyvek > Angol > Folyóiratok, újságok

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Gazdaságpolitika

- Folyóiratok, újságok > Közgazdaságtan

- Közgazdaságtan > Folyóiratok, közlemények

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Folyóiratok, közlemények

- Idegennyelv > Idegennyelvű könyvek > Angol > Közgazdaságtan > Közgazdasági elméletek > Egyéb